SUMMARY

Early life:

Yunus was born on 28 June

1940 to a Muslim family in Hathazarai, Chittagong. In 1940, that was part of

British-controlled India. But, after independence in 1947, became East

Pakistan. (and later Bangladesh)

Yunus was an excellent

student, becoming one of the best students in the year at Chittagong Collegiate

School, and later Chittagong College. He completed a BA degree in economics at

Dhaka University in 1960, and his MA in 1961.

After

graduation, he taught

economics at Chittagong College and served as a research assistant under

Nurul

Islam. In 1965 he gained a Fulbright scholarship to study in the UN.

Later in

1971, he gained a PhD in economics from the Vanderbilt University

Graduate Program in Economic Development. He also worked as an assistant professor of

economics at Middle Tennessee State University.

In 1970, he met Vera

Forostenko a Russian immigrant to the US. They had one child, Monica Yunus, but

Vera did not want to live in Bangladesh and the couple split. Yunus later

married Afrozi Yunus, and they had one daughter Deena Afroz Yunus.

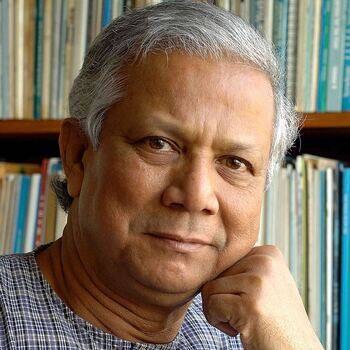

Muhammad Yunus is a Bangladeshi banker and

recipient of the Nobel Peace Prize (2006). Yunus is credited with developing

the concepts of microfinance and microcredit. These are schemes which offer

small loans to the rural poor – to enable them to invest and lift themselves

out of poverty.

“When we want to help the poor, we usually

offer them charity. Most often we use charity to avoid recognizing the problem

and finding the solution for it. Charity becomes a way to shrug off our

responsibility. But charity is no solution to poverty.

Yunus decided to lend some

of his own money to 42 women in the village of Jobra, near Chittagong. It was

only a total of US$27, and he was repaid with a profit of $0.02 on each loan.

This convinced him microloans were a viable business model.

Video

Lecture Links:

Comments

Post a Comment