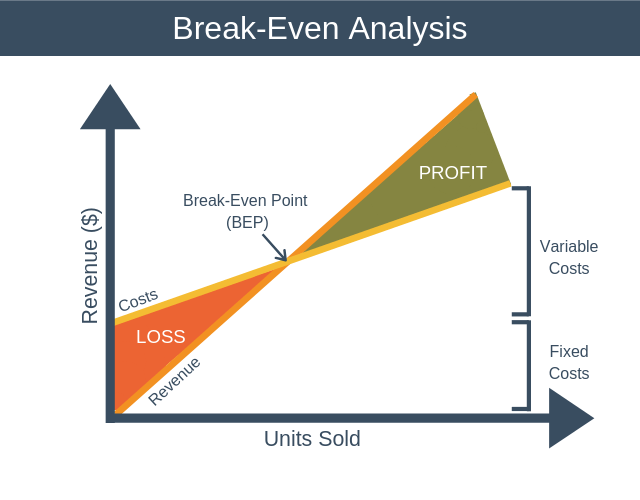

Concept of Break-Even Analysis:

Break-Even

Analysis is a concept used very widely in production management and

cost. It is an analytical tool which helps the firm to identify that

level

of sale where it will cover its cost of production. Any sale over and

above the

break- Even Point will accrue profits to the firm, while any sales less

than it

would put the firm into losses. The Break-Even Point shows the price at

which

the firm makes neither profit nor loss. Break-Even point is a very

significant

concept in Economics and business, especially in Cost Accounting.

Break-Even

point is a point where the cost of production and the revenue from

sales are exactly equal to each other; which means that the firm has neither

made profits nor has incurred any losses. The Break-Even Analysis is also

known as the Cost- Volume- Profit Analysis and is used to study the

relationship between total cost, total revenue, profits and losses. It also

helps to determine that level of output which is required to cover the

operating costs of a business.

Limitations of Break-Even Analysis:

For the break-

even point to be counted, all costs need to be clearly categorized in fixed and

variable costs, which may not be possible every time.

For the multiple-

product or joint- product operations, it is difficult to apply the break-even

analysis. on needs to ascertain the costs to each product, hence the

analysis is applicable only for a single product.

The computation of the break-even point is based on the historical information. If this information

is not relevant, the analysis cannot be applied usefully.

Significance of Break-Even Analysis:

The

break-even

analysis helps us to determine the levels of sales necessary to meet all

the

operating costs. With the estimates of revenue and costs, we can

forecast the

profits. One can also appraise the effects of change in price, fixed

costs and

variable cost on sales volume, total cost and total revenue and in turn,

on the break-even point. One can compare the profit earning capacities

of different

firms. It can also bring out the significance of capacity utilization

for

achieving economy.

Video

Lecture Links:

Comments

Post a Comment