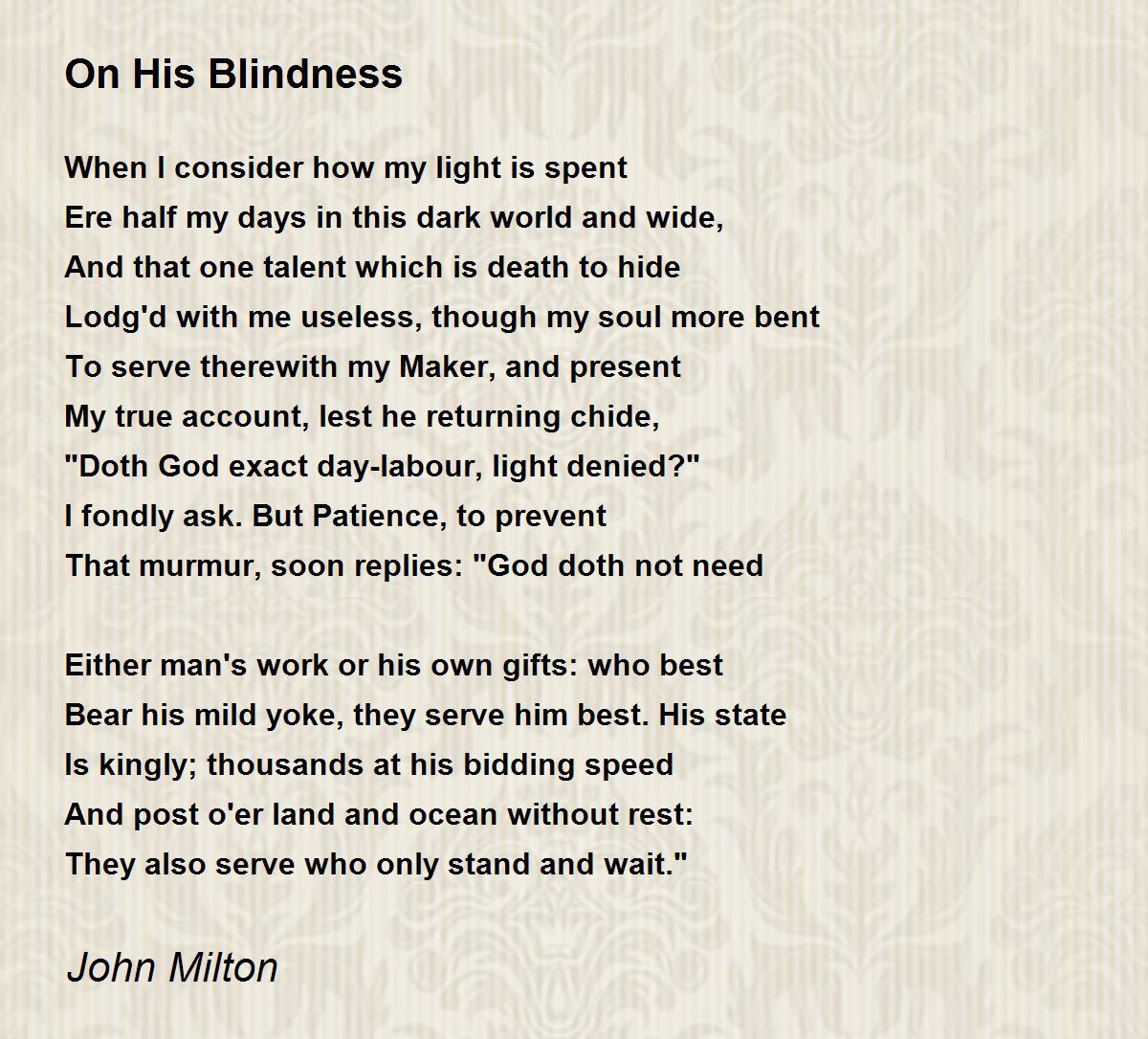

John Milton’s

poem “On His Blindness” is an autobiographical sonnet in which Milton meditates

on his own loss of sight. For most of his life, Milton had been able to see

perfectly, but his late-night reading and writing on behalf of the government

of the short-lived English Republic, in which he held a very prominent

position, helped ruin his eyesight. This sonnet—written in the “Petrarchan”

rhyme scheme associated with the fourteenth-century Italian poet Francesco

Petrarca—is divided into an eight-line “octave” and a six-line “sestet.” The

octave rhymes abba abba.

The sestet rhymes cde

cde. The sonnet is, therefore, a typical Petrarchan sonnet in

form, but in subject matter, the poem departs from the topics usually

associated with Petrarchan poems. Petrarch (the English version of Petrarca’s

name) was most famous for writing about love; Milton departs from that

conventional topic to deal with a very practical, very physical problem, but a

problem with many broader spiritual implications.

By beginning line one with the word “When,"

Milton immediately signals that he is opening with a subordinate clause (a

dependent clause) that introduces the main idea to follow. Beginning the poem

this way creates a certain suspense; the main idea is postponed so that we have

to continue reading in anticipation of its eventual arrival. Shakespeare also

often used this kind of sentence pattern in constructing his own sonnets. By

opening with a dependent clause, Milton heightens our sense of anticipation by

delaying the key statement.

The word “consider” implies careful, rational thought

rather than purely emotional reaction. Here and throughout the poem, the

speaker uses his reason, which Renaissance Christians considered one of the

greatest gifts that God had bestowed upon human beings. The ability of humans

to reason, they believed, linked them to God and distinguished them from

animals. The speaker feels that his “light” is “spent” (extinguished) in

several senses of the word “light.” This word clearly alludes, at least

eventually, to the speaker’s loss of sight, but "light" may also

suggest one’s intelligence. The opening line may at first seem to mean “When I

think about how I have used my intelligence,” but it soon comes to mean “When I

ponder how my ability to see has become extinguished.” This latter meaning is,

of course, foreshadowed by the poem’s title.

The idea of losing one’s sight is obviously a deeply

troubling one. The blind person is suddenly at risk in all kinds of ways. The

speaker in the poem feels vulnerable; he can no longer literally see his own

way or easily protect himself from dangers. The special tragedy of

this particular speaker is that he has lost his sight at an unusually early

stage of life. Rather than becoming blind when elderly, he has become blind in

middle age. He now inhabits a world that seems “dark” (2) in at least two

senses: it is no longer physically visible, and it is a world full of sin and

spiritual darkness. The world, moreover, is not only dark but also “wide”: the

speaker will somehow have to navigate, both literally and figuratively, in a

world which, because of its width or breadth, will prose many dangers. If the

speaker were confined to a single dark room, he might quickly and easily learn

his way around...

Comments

Post a Comment